Supply and Demand – Introduction to Microeconomics |

您所在的位置:网站首页 › when quantity demanded decreases › Supply and Demand – Introduction to Microeconomics |

Supply and Demand – Introduction to Microeconomics

|

Table 3.5 Market Supply versus Individual Supply

Price

QS1

QS2

QS3

=

Market QS

$1.00

75

125

60

=

260

$1.50

90

140

80

=

310

$2.00

110

170

100

=

380

$2.50

130

190

120

=

440

$3.00

140

205

130

=

475

$3.50

145

210

135

=

490

Shifts in Supply

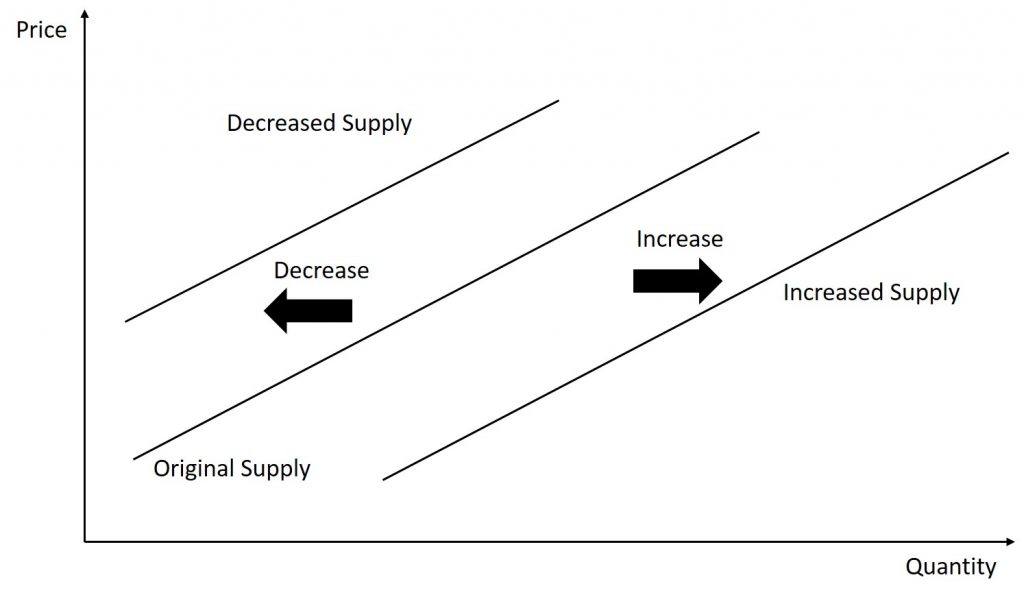

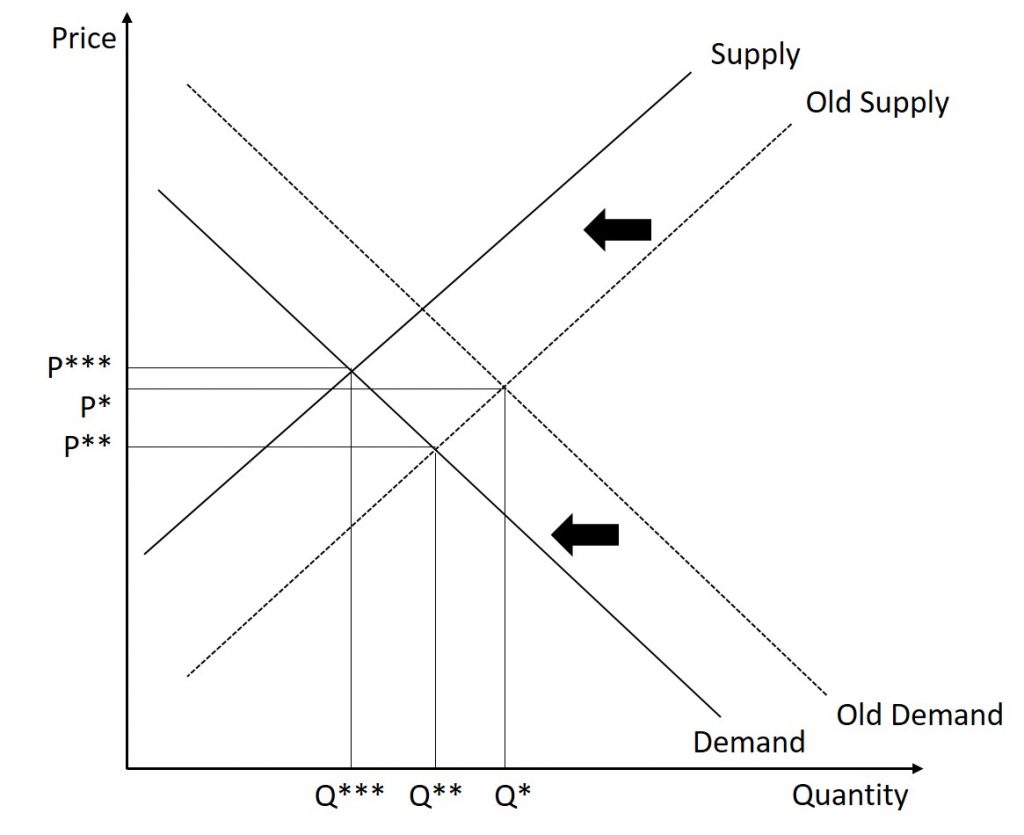

The previous module explored how price affects the quantity supplied. The result was the supply curve. Price, however, is not the only factor that influences supply. For example, how is the supply of diamonds affected if diamond producers discover several new diamond mines? What are the major factors, in addition to the price, that influence supply? These factors matter for both individual and market supply as a whole. Exactly how do these various factors affect supply, and how do we show the effects graphically? To answer those questions, we need the ceteris paribus assumption. A supply curve is a relationship between two, and only two, variables: quantity on the horizontal axis and price on the vertical axis. The assumption behind a supply curve is that no relevant economic factors, other than the product’s price, are changing. Economists call this assumption ceteris paribus, a Latin phrase meaning “other things being equal.” Any given supply curve is based on the ceteris paribus assumption that all else is held equal. A supply curve is a relationship between two, and only two, variables when all other variables are kept constant. We will discuss a total of six factors which cause the supply curve to shift. Again, notice INEPTT. These include: Input prices (cost of production) Number of suppliers Expectations Price of alternative goods Technology TaxesEach will be discussed in more depth shortly. Before we do that, let us explore what a change in supply actually is. Recall, when the price of a good changes, we move along the supply curve. That is, when the price changes, the quantity supplied changes, but the supply stays the same (meaning we stay on the same demand curve.) On the other hand, when one of the shifters above changes, the entire supply curve moves. An increase in supply is shown by an outward shift while a decrease in supply is shown by an inward shift. Be sure to think about shifts as inward or outward. If you think about the shift as moving the curve up or down, you will likely make mistakes with the supply curve. This is shown graphically below.  Figure 3.4 Shifts in Supply Figure 3.4 Shifts in Supply

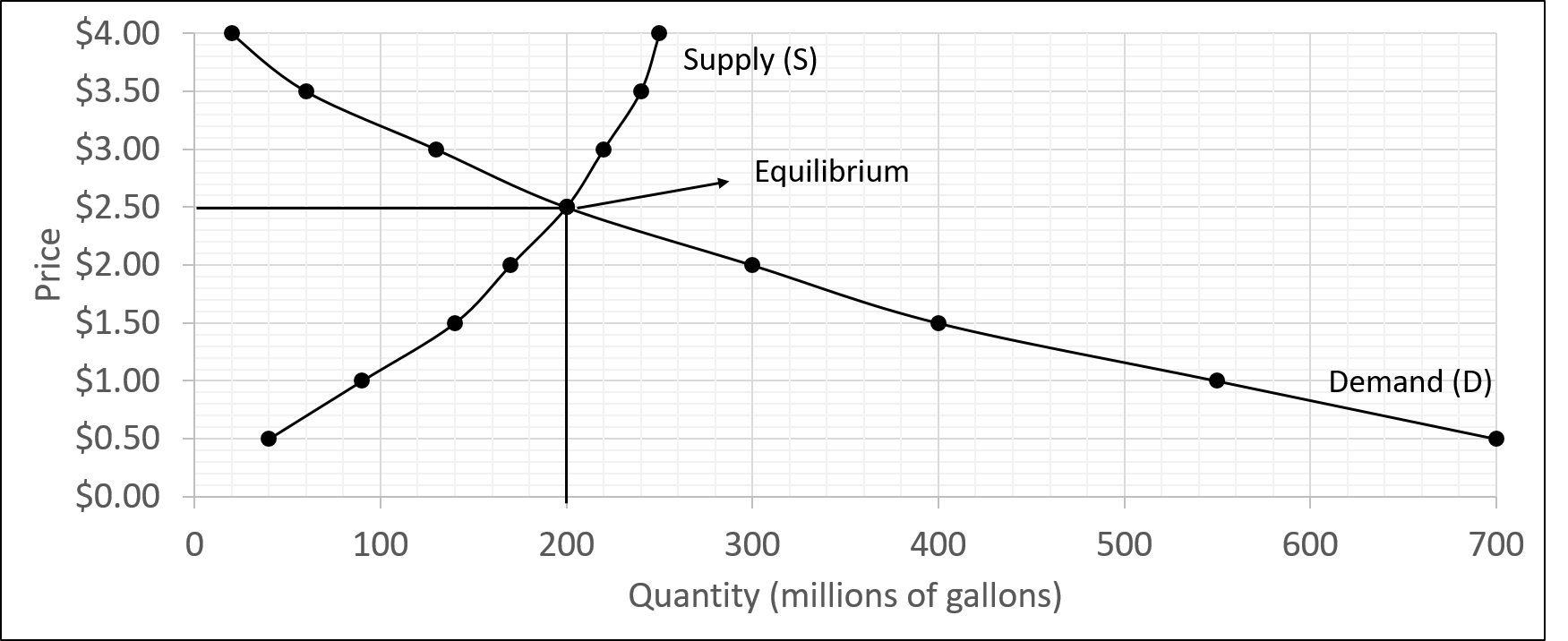

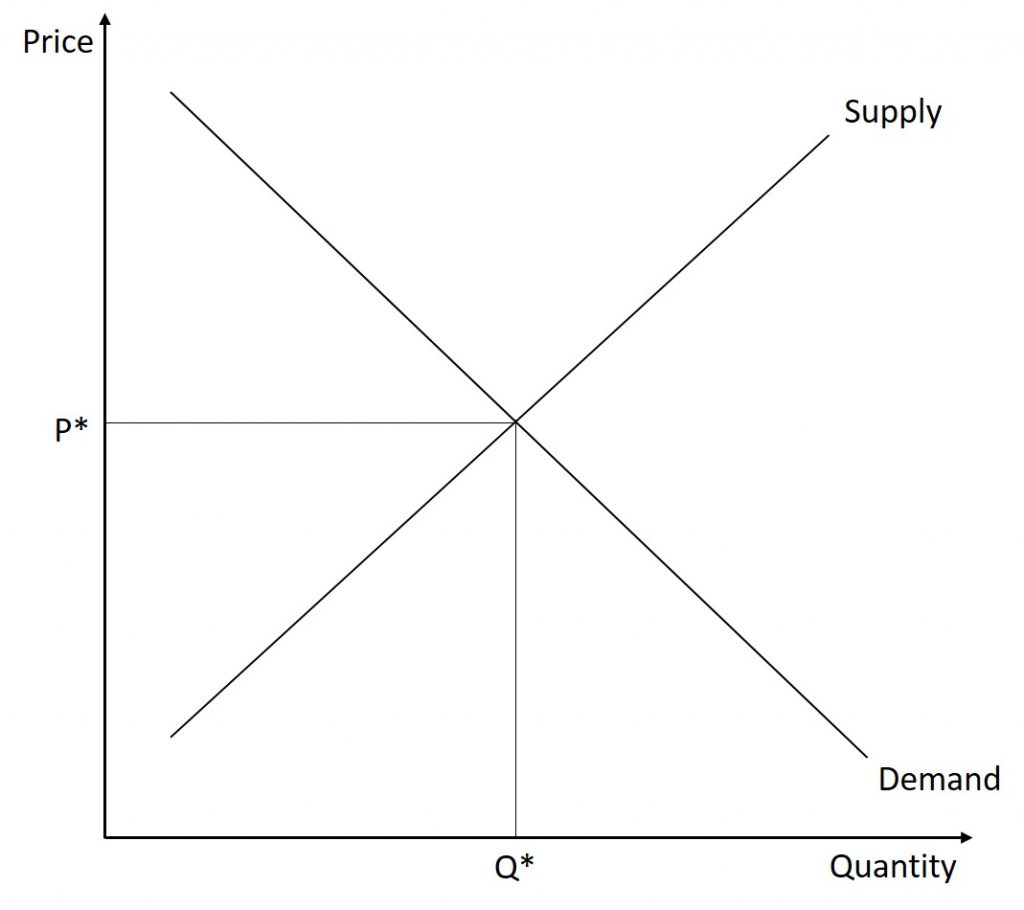

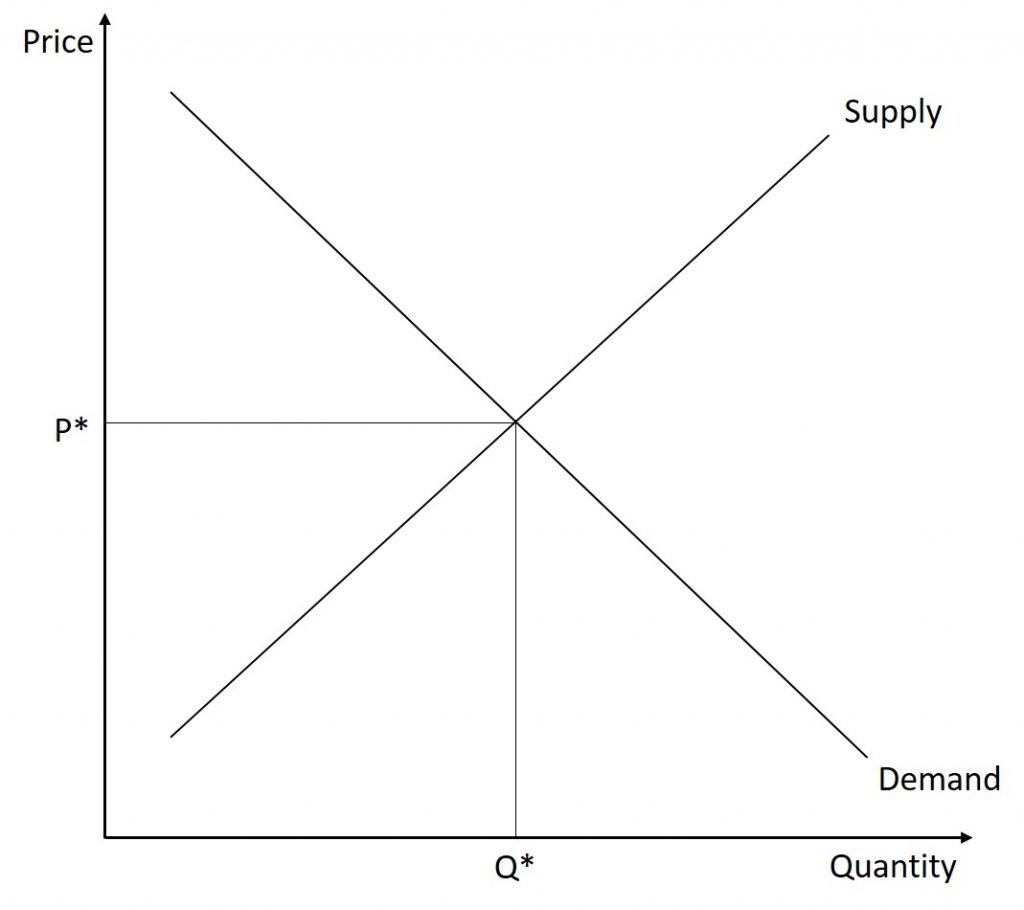

Numerically, what a shift means is that the quantity supplied will be different at each price level. The table below shows a both an increase and decrease in supply using the supply schedule presented earlier in the chapter. Table 3.6 A Change in Supply Price (per gallon) Decrease in Supply Original Supply Increase in Supply $0.50 20 40 70 $1.00 65 90 130 $1.50 110 140 190 $2.00 150 170 240 $2.50 175 200 280 $3.00 190 220 310 $3.50 200 240 340 $4.00 205 250 360Now that we have explored what supply shifts look like, let us examine what can cause these changes. Remember, if the price of the good changes, we move along the supply curve (meaning the supply curve does not move.) It is only if one of the following factors change that the entire supply curve will move. Input CostsA supply curve shows how quantity supplied will change as the price rises and falls, assuming ceteris paribus so that no other economically relevant factors are changing. If other factors relevant to supply do change, then the entire supply curve will shift. Just as we described a shift in demand as a change in the quantity demanded at every price, a shift in supply means a change in the quantity supplied at every price. In thinking about the factors that affect supply, remember what motivates firms: profits, which are the difference between revenues and costs. A firm produces goods and services using combinations of labor, materials, and machinery, or what we call inputs or factors of production. If a firm faces lower costs of production, while the prices for the good or service the firm produces remain unchanged, a firm’s profits go up. When a firm’s profits increase, it is more motivated to produce output, since the more it produces the more profit it will earn. When costs of production fall, a firm will tend to supply a larger quantity at any given price for its output. We can show this by the supply curve shifting to the right. Take, for example, a messenger company that delivers packages around a city. The company may find that buying gasoline is one of its main costs. If the price of gasoline falls, then the company will find it can deliver messages more cheaply than before. Since lower costs correspond to higher profits, the messenger company may now supply more of its services at any given price. For example, given the lower gasoline prices, the company can now serve a greater area and increase its supply. Conversely, if a firm faces higher costs of production, then it will earn lower profits at any given selling price for its products. As a result, a higher cost of production typically causes a firm to supply a smaller quantity at any given price. In this case, the supply curve shifts to the left. Imagine that the price of steel, an important ingredient in manufacturing cars, rises, so that producing a car has become more expensive. At any given price for selling cars, car manufacturers will react by supplying a lower quantity. We can show this graphically as a leftward shift of supply. Conversely, if the price of steel decreases, producing a car becomes less expensive. At any given price for selling cars, car manufacturers can now expect to earn higher profits, so they will supply a higher quantity. The shift of supply to the right. Number of SuppliersThis shifter is a bit more straightforward. This shifter is typically thought of as the number of firms. Put simply, as more firms enter the market, the supply will increase and vice versa. ExpectationsJust as was the case with demand, firms will make decisions not only using current conditions but will also use expected changes to make decisions as well. For instance, if a firm expects the value of its product to increase in six months, they may temporarily decrease the amount of product they make available in order to make more of it available when the price goes up sometime in the future. For example, toy companies produce a significant amount of inventory throughout the year but do not make it available for sale until the holiday season. In addition, if a firm expects the cost of its inputs to rise, they may increase production today to avoid the higher cost of production that may occur later. Price of Alternative GoodsHere we consider a single firm that produces more than one good. We know from the previous chapter that firms face a production possibilities frontier meaning that they can only produce so much given their factors of production. Therefore, the profitability of one good may impact the supply of another. For example, consider a firm that produces widgets and gizmos. Now, suppose that the price of a widget increases. Since the price of the widget went up, the quantity supplied of widgets will increase. But, in order to produce more widgets, the firm must shift some resources away from gizmo production. Therefore, the supply of gizmos decreases. Be careful with terminology here. In the previous example, when the price of the widget changed, the quantity supplied of widgets changed, but the supply of gizmos changed. This is because the price of gizmos did not impact gizmo; instead, if was an external factor (in this case, the price of widgets) that affected production. In summary, when the price of an alternative good (produced by the same firm) increases, the supply of the other good decreases and vice versa. TechnologyWhen a firm discovers a new technology that allows the firm to produce at a lower cost, the supply curve will shift to the right, as well. For instance, in the 1960s a major scientific effort nicknamed the Green Revolution focused on breeding improved seeds for basic crops like wheat and rice. By the early 1990s, more than two-thirds of the wheat and rice in low-income countries around the world used these Green Revolution seeds—and the harvest was twice as high per acre. A technological improvement that reduces costs of production will shift supply to the right so that a greater quantity will be produced at any given price. TaxesGovernment policies can affect the cost of production and the supply curve through taxes, regulations, and subsidies. For example, the U.S. government imposes a tax on alcoholic beverages that collects about $8 billion per year from producers. Businesses treat taxes as costs. Higher costs decrease supply for the reasons we discussed above. Other examples of policy that can affect cost are the wide array of government regulations that require firms to spend money to provide a cleaner environment or a safer workplace. Complying with regulations increases costs. A government subsidy, on the other hand, is the opposite of a tax. A subsidy occurs when the government pays a firm directly or reduces the firm’s taxes if the firm carries out certain actions. From the firm’s perspective, taxes or regulations are an additional cost of production that shifts supply to the left, leading the firm to produce a lower quantity at every given price. Government subsidies reduce the cost of production and increase supply at every given price, shifting supply to the right. 3.3 putting supply and demand together EquilibriumBecause the graphs for demand and supply curves both have price on the vertical axis and quantity on the horizontal axis, the demand curve and supply curve for a particular good or service can appear on the same graph. Together, demand and supply determine the price and the quantity that will be bought and sold in a market. Remember this: When two lines on a diagram cross, this intersection usually means something. The point where the supply curve (S) and the demand curve (D) cross in the figure below is called the equilibrium. The equilibrium price is the only price where the plans of consumers and the plans of producers agree—that is, where the amount of the product consumers want to buy (quantity demanded) is equal to the amount producers want to sell (quantity supplied). Economists call this common quantity the equilibrium quantity. At any other price, the quantity demanded does not equal the quantity supplied, so the market is not in equilibrium at that price.  Figure 3.5 A Market in Equilibrium

Table 3.7 A Market in Equilibrium

Price (per gallon)

Quantity Demanded (millions of gallons)

Quantity Supplied (millions of gallons)

$0.50

700

40

$1.00

550

90

$1.50

400

140

$2.00

300

170

$2.50

200

200

$3.00

130

220

$3.50

60

240

$4.00

20

250 Figure 3.5 A Market in Equilibrium

Table 3.7 A Market in Equilibrium

Price (per gallon)

Quantity Demanded (millions of gallons)

Quantity Supplied (millions of gallons)

$0.50

700

40

$1.00

550

90

$1.50

400

140

$2.00

300

170

$2.50

200

200

$3.00

130

220

$3.50

60

240

$4.00

20

250

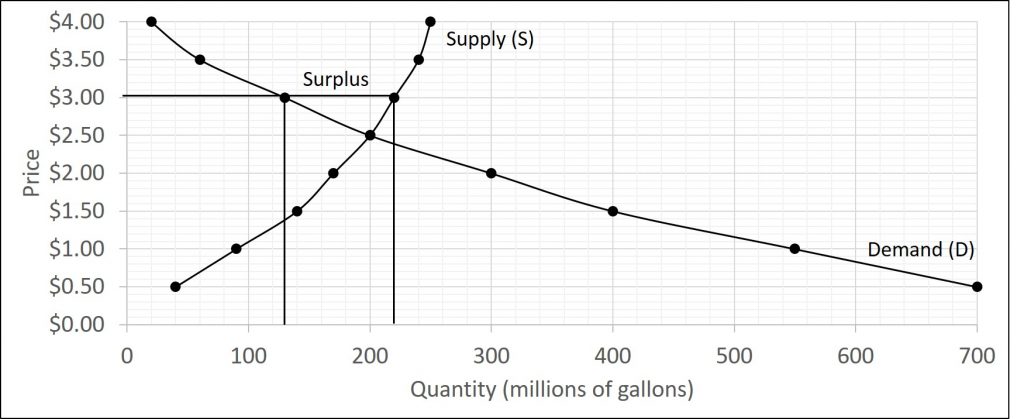

In the figure above, the equilibrium price is $2.50 per gallon of gasoline and the equilibrium quantity is 200 million gallons. If you had only the demand and supply schedules, and not the graph, you could find the equilibrium by looking for the price level on the tables where the quantity demanded and the quantity supplied are equal. The word “equilibrium” means “balance.” If a market is at its equilibrium price and quantity, then it has no reason to move away from that point. However, if a market is not at equilibrium, then economic pressures arise to move the market toward the equilibrium price and the equilibrium quantity. Market FailuresImagine, for example, that the price of a gallon of gasoline was above the equilibrium price—that is, instead of $2.50 per gallon, the price is $3.00 per gallon. The horizontal line at the price of $3.00 in the figure below illustrates this above equilibrium price. At this higher price, the quantity demanded drops from 200 to 130. This decline in quantity reflects how consumers react to the higher price by finding ways to use less gasoline.  Figure 3.6 Surplus Figure 3.6 Surplus

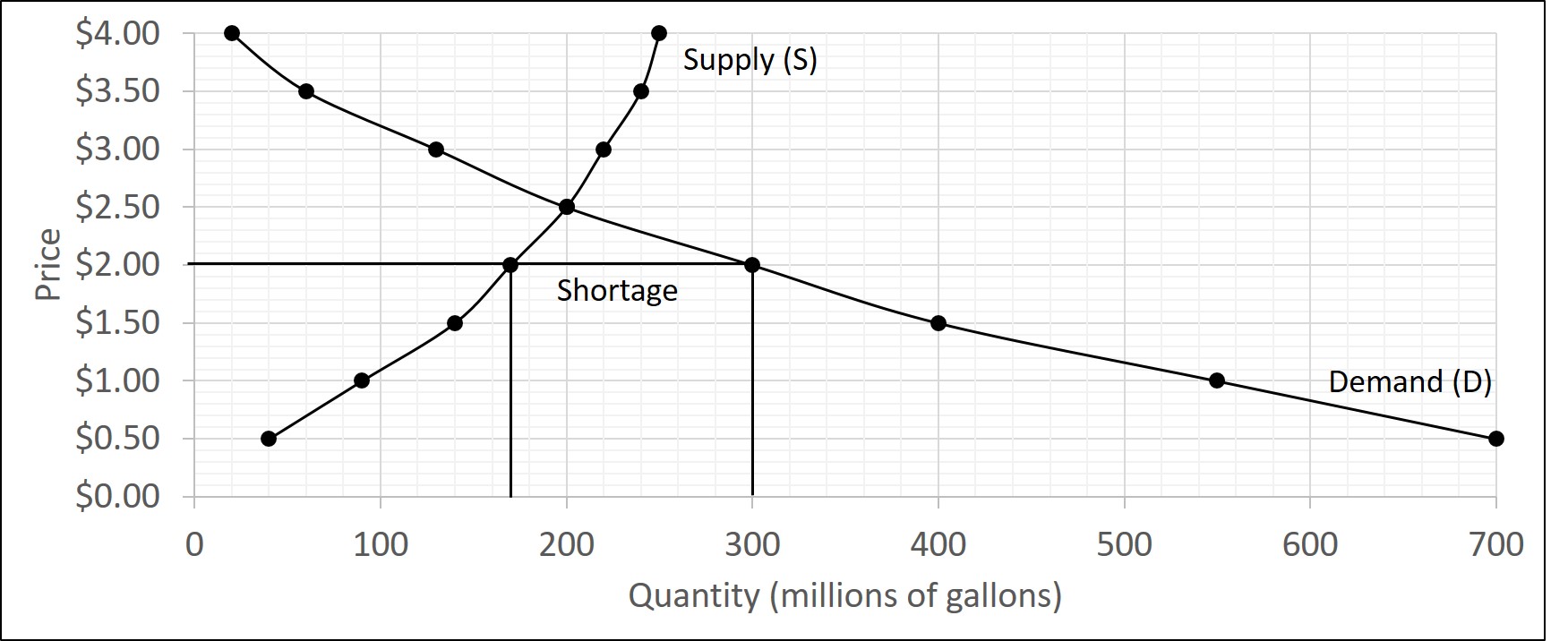

Moreover, at this higher price of $3.00, the quantity of gasoline supplied rises from the 200 to 220, as the higher price makes it more profitable for gasoline producers to expand their output. Now, consider how quantity demanded and quantity supplied are related at this above-equilibrium price. Quantity demanded has fallen to 130 gallons, while quantity supplied has risen to 220 gallons. In fact, at any above-equilibrium price, the quantity supplied exceeds the quantity demanded. We call this an excess supply or a surplus. In this example, the surplus is 220-130=90 million gallons. With a surplus, gasoline accumulates at gas stations, in tanker trucks, in pipelines, and at oil refineries. This accumulation puts pressure on gasoline sellers. If a surplus remains unsold, those firms involved in making and selling gasoline are not receiving enough cash to pay their workers and to cover their expenses. In this situation, some producers and sellers will want to cut prices, because it is better to sell at a lower price than not to sell at all. Once some sellers start cutting prices, others will follow to avoid losing sales. These price reductions, in turn, will stimulate a higher quantity demanded. Therefore, if the price is above the equilibrium level, incentives built into the structure of demand and supply will create downward price pressure.  Figure 3.7 Shortage Figure 3.7 Shortage

Now suppose that the price is below its equilibrium level at $2.00 per gallon, as the horizontal line at this price in Figure 3.7 shows. At this lower price, the quantity demanded increases from 200 to 300 as drivers take longer trips, spend more minutes warming up the car in the driveway in wintertime, stop sharing rides to work, and buy larger cars that get fewer miles to the gallon. However, the below-equilibrium price reduces gasoline producers’ incentives to produce and sell gasoline, and the quantity supplied falls from 200 to 170. When the price is below equilibrium, there is excess demand, or a shortage—that is, at the given price the quantity demanded, which has been stimulated by the lower price, now exceeds the quantity supplied, which had been depressed by the lower price. In our example, the shortage is 300-170=130 millions of gallons. In this situation, eager gasoline buyers mob the gas stations, only to find many stations running short of fuel. Oil companies and gas stations recognize that they have an opportunity to make higher profits by selling what gasoline they have at a higher price. As a result, the price rises toward the equilibrium level. Algebraic EquilibriumInstead of using schedules or graphs to examine the supply and demand within a market, we can also express both as equations. This allows us to compact all of the information into a single mathematical expression. For instance, consider the demand equation below: [latex]Q_{D}=30-5P.[/latex] We can plug any price in and get the quantity demanded. For example, when the price is set at $3, the quantity demanded is [latex]Q_{D}=30-5(3)=30-15=15.[/latex] The same applies to the supply equation as well. A market is in equilibrium when quantity demanded is equal to quantity supplied. Algebraically, this is accomplished by setting the demand equation equal to the supply equation. Then, you can solve for price. After you solve for price, you need to determine the equilibrium quantity. To accomplish this, plug the equilibrium price into either the demand or supply equation. To check your work, you can plug the equilibrium price into the other equation (depending on which equation you used first.) The quantities should be equal as this is the equilibrium condition (the quantity demanded must equal the quantity supplied.) For example, let us find the equilibrium in the following market: [latex]Q_{D}=30-5P[/latex] [latex]Q_{S}=14+3P[/latex] First, we set the equations equal: [latex]Q_{D}=Q_{S}\Rightarrow 30-5P=14+3P[/latex] Next, we solve for P: [latex]30-5P+(-14+5P)=14+3P+(-14+5P) \Rightarrow 8P=16 \Rightarrow P=\frac{16}{8}[/latex] Now, we plug the equilibrium price into the demand (or supply) equation: [latex]Q_{D}=30-5(2)=30-10=20 \Rightarrow Q*=20.[/latex] Finally, we can check our work by plugging the equilibrium price into the other equation. Since we used demand already, we will plug it into supply. [latex]Q_{S}=14+3(2)=14+6=20 \Rightarrow Q*20.[/latex] Therefore, the equilibrium price is $2 and the equilibrium quantity is 20 units. Try the following problem: Find the equilibrium price and quantity in the following market: [latex]Q_{D}=600-10P[/latex] [latex]Q_{S}=200+15P[/latex] [latex]Q_{D}=Q_{S}=600-10P=200+15P.[/latex] Solving for P: [latex]600-10P+(10P-200)=200+15P+(10P-200)\Rightarrow 25P=400[/latex] [latex]\Rightarrow P=\frac{400}{25} \Rightarrow P^{*}=16.[/latex] Plugging the equilibrium price into the demand equation: [latex]Q_{D}=600-10(16)=440 \Rightarrow Q^{*}=440.[/latex] Next, to check our work, we plug the equilibrium price in to the supply equation. We should get the same quantity. [latex]Q_{S}=200+15(16)=440.[/latex] Therefore, the equilibrium price is $16 and the equilibrium quantity is 440 units. We can also explore market failures algebraically as well. For example, consider the first example. What if the price in the market were set at $1.50. We can plug $1.50 into both the demand and supply equations: [latex]Q_{D}=30-5(1.50)=22.5[/latex] [latex]Q_{S}=14+3(1.50)=18.5[/latex] Therefore, we face a shortage (since quantity supplied is less than quantity demanded) of 22.5-18.5=4 units. 3.4 Modeling market disequilibrium Single ShiftsLet’s begin this discussion with a single economic event. It might be an event that affects demand, like a change in income, population, tastes, prices of substitutes or complements, or expectations about future prices. It might be an event that affects supply, like a change in natural conditions, input prices, or technology, or government policies that affect production. How does this economic event affect equilibrium price and quantity? We will analyze this question using a four-step process. Step 1. Draw a demand and supply model before the economic change took place. To establish the model requires four standard pieces of information: The law of demand, which tells us the slope of the demand curve; the law of supply, which gives us the slope of the supply curve; the shift variables for demand; and the shift variables for supply. From this model, find the initial equilibrium values for price and quantity. Step 2. Decide whether the economic change you are analyzing affects demand or supply. In other words, does the event refer to something in the list of demand factors or supply factors? Which specific factor is it affecting? Then, decide whether the effect on demand or supply causes the curve to shift to the right or to the left, and sketch the new demand or supply curve on the diagram. In other words, does the event increase or decrease the amount consumers want to buy or producers want to sell? Step 3. It is important to remember that in step 2, the only thing to change was the supply or demand. Therefore, coming into step 3, the price is still equal to the initial equilibrium price. Since either supply or demand changed, the market is in a state of disequilibrium. Thus, there is either a surplus or shortage. Determine which one exists. Next, determine what prices must do to reequilibrate the market. Remember, if there is a shortage, there will be upward price pressure and if there is a surplus, then there is downward price pressure. Prices continue to adjust until the market achieves a new equilibrium. Step 4. Identify the new equilibrium and then compare the original equilibrium price and quantity to the new equilibrium price and quantity. Example 1 (Supply)Scenario: The market for fast food in a certain town is initially in equilibrium. Several new fast-food restaurants open in the town. Show the impact of the new fast-food restaurants on the equilibrium price and quantity of fast food in this town. Step 1. We begin by creating a supply and demand graph that is initially in equilibrium.  Figure 3.8 Market Disequilibrium, Step 1 Figure 3.8 Market Disequilibrium, Step 1

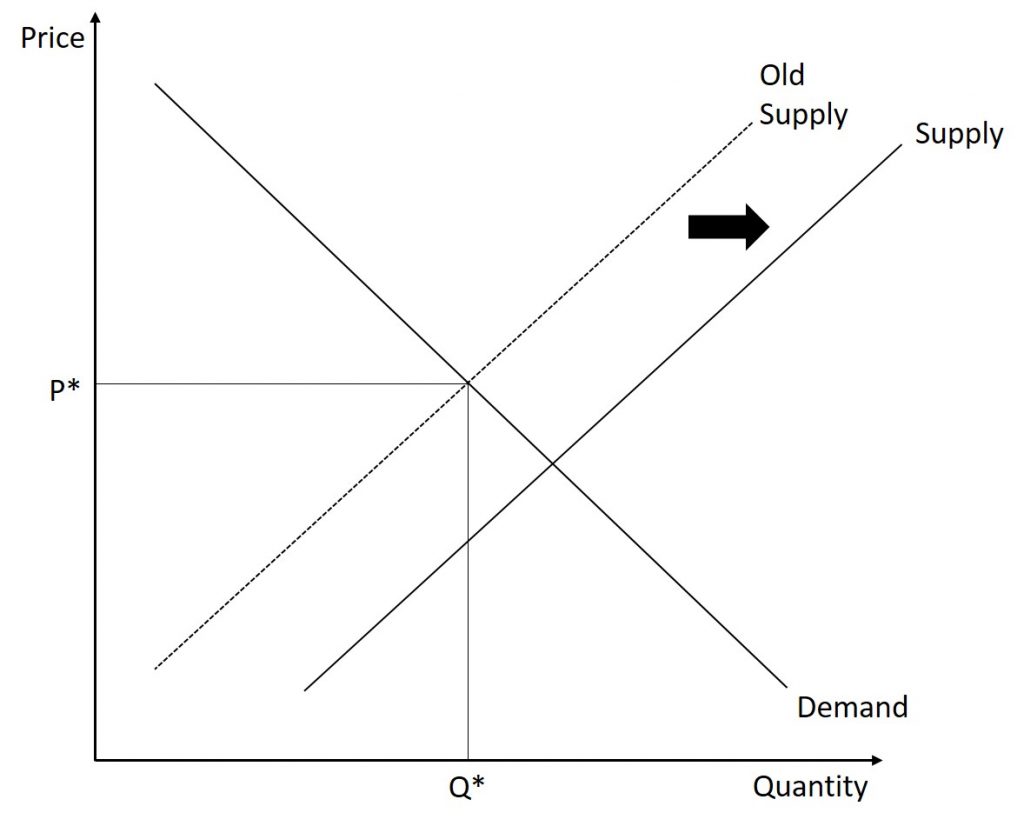

Step 2. This change affects the supply of fast food. Specifically, the number of suppliers has increased. Therefore, the supply of fast food has increased. This causes an outward shift of the supply curve.  Figure 3.9 Market Disequilibrium, Step 2 Figure 3.9 Market Disequilibrium, Step 2

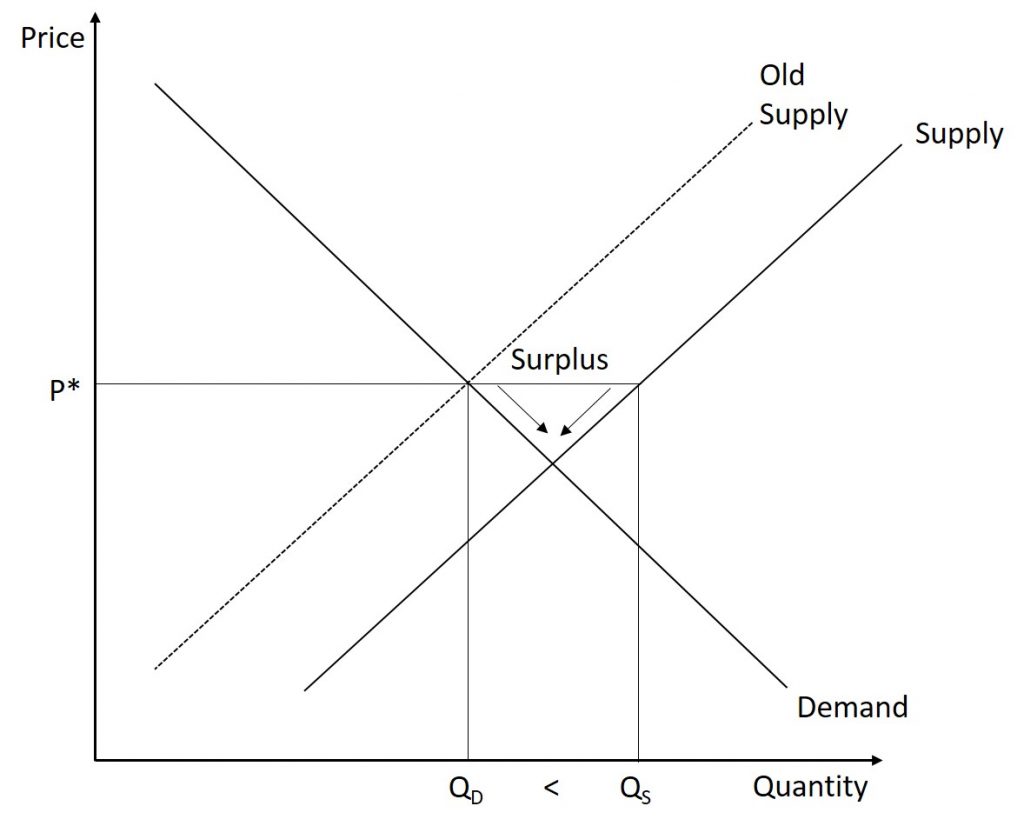

Step 3. At the original price level, the quantity demanded is less than the quantity supplied. Therefore, the market currently has a surplus. In order to alleviate the surplus, the price of fast food must begin to fall (downward price pressure.) This continues until the market achieves its new equilibrium.  Figure 3.10 Market Disequilibrium, Step 3 Figure 3.10 Market Disequilibrium, Step 3

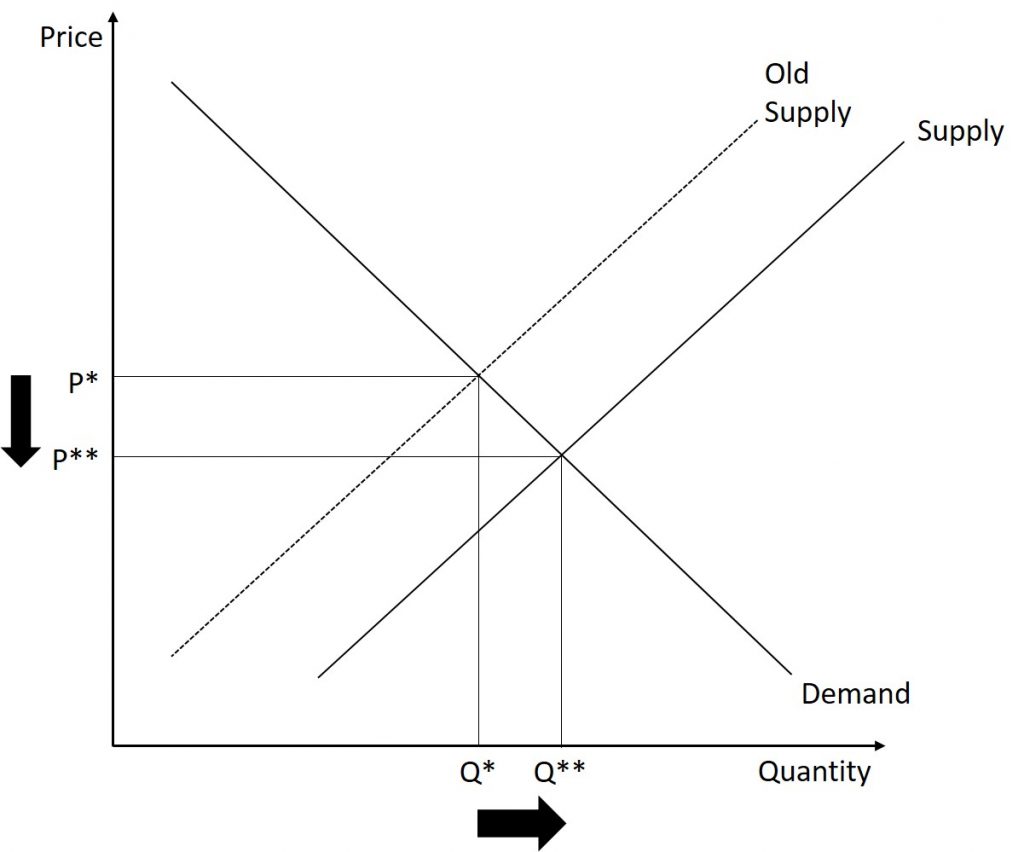

Step 4. We now compare the initial equilibrium to the new equilibrium. We can see that the price of fast food has fallen but the quantity of fast food has increased.  Figure 3.11 Market Disequilibrium, Step 4

Example 2 (Demand) Figure 3.11 Market Disequilibrium, Step 4

Example 2 (Demand)

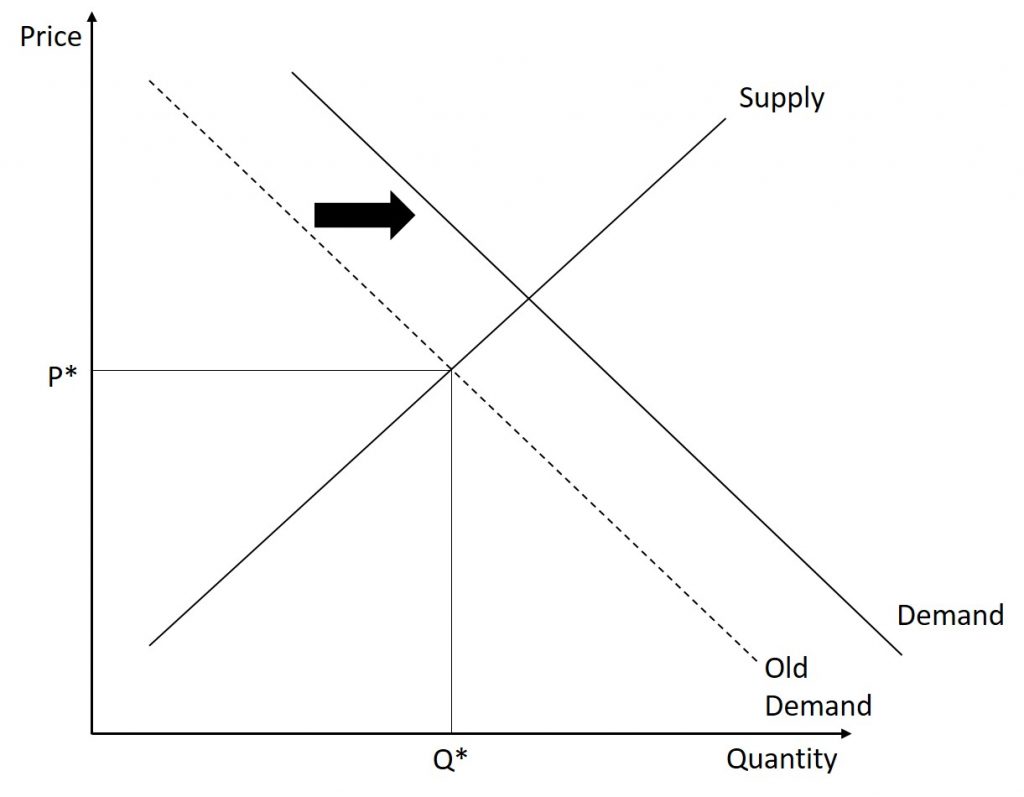

Scenario: The market for pickup trucks is initially in equilibrium. A new marketing campaign is successful and creates a new desire to own pickup trucks. Show the impact of the advertising campaign on the equilibrium price and quantity of pickup trucks. Step 1. We begin by creating a supply and demand graph that is initially in equilibrium.  Figure 3.12 Market Disequilibrium, Step 1 Figure 3.12 Market Disequilibrium, Step 1

Step 2. This change affects the demand for pickup trucks. Specifically, the tastes of consumers have changed. Therefore, the demand for pickup trucks has increased. This causes an outward shift of the demand curve.  Figure 3.13 Market Disequilibrium, Step 2 Figure 3.13 Market Disequilibrium, Step 2

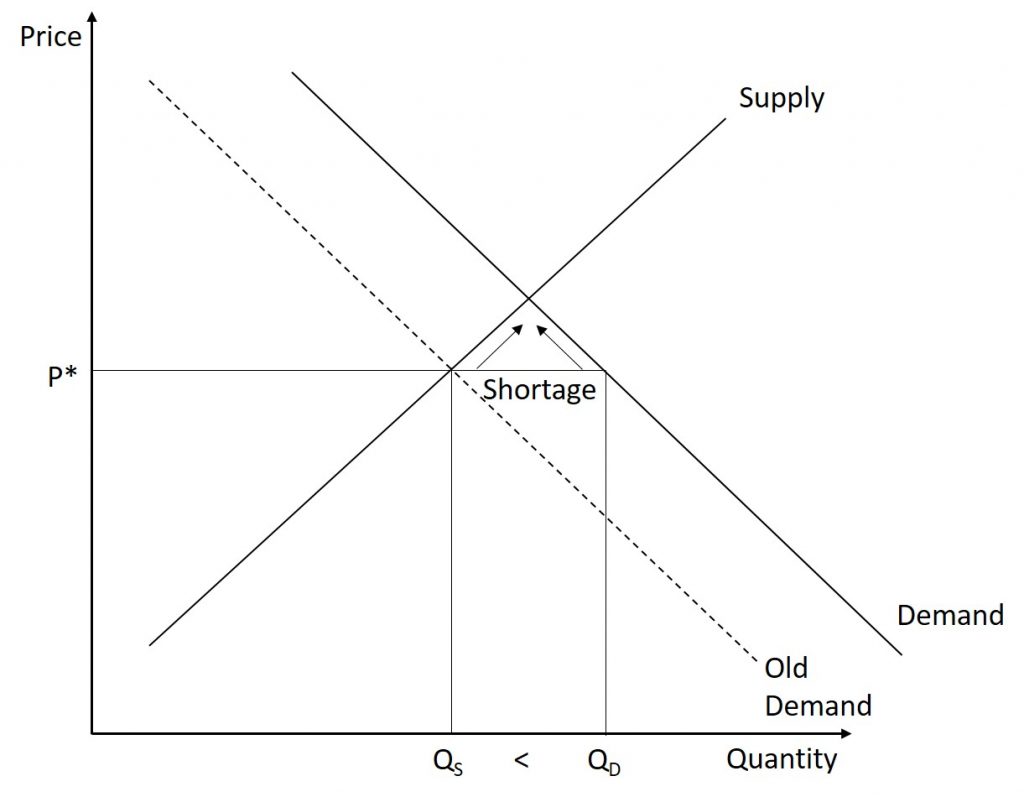

Step 3. At the original price level, the quantity supplied is less than the quantity demanded. Therefore, the market currently has a shortage. In order to alleviate the shortage, the price of pickup trucks will begin to increase (upward price pressure.) This continues until the market achieves its new equilibrium.  Figure 3.14 Market Disequilibrium, Step 3 Figure 3.14 Market Disequilibrium, Step 3

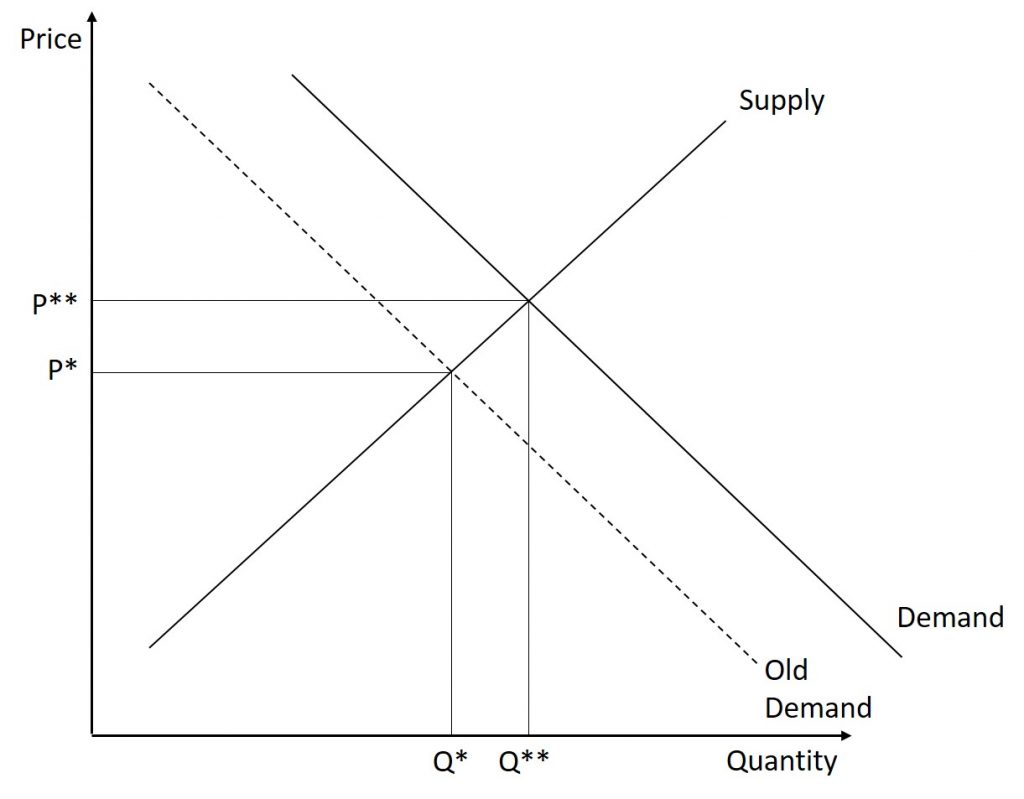

Step 4. We now compare the initial equilibrium to the new equilibrium. We can see that the price of pickup trucks has increased and the quantity of pickup trucks has increased.  Figure 3.15 Market Disequilibrium, Step 4

Summary of Shifts Figure 3.15 Market Disequilibrium, Step 4

Summary of Shifts

Regardless of the cause of the shift, there are only a total of four possible cases. We can have an increase or decrease in supply or demand. Each scenario has its own unique template. The results are summarized below. Table 3.8 A Summary of Shifts Curve Shift / Change Increase Decrease Demand P↑ Q↑ P↓ Q↓ Supply P↓ Q↑ P↑ Q↓ Double ShiftsIn the previous examples, we examined the impact of a single change on the market. We saw that either supply or demand shifted (not both) and the curve only shifted once. But in reality, it is possible for several factors to change at the same time. Let us explore how we can model several changes within one graph. ExampleThe U.S. Postal Service is facing difficult challenges. Compensation for postal workers tends to increase most years due to cost-of-living increases. At the same time, increasingly more people are using email, text, and other digital message forms such as Facebook and Twitter to communicate with friends and others. What does this suggest about the continued viability of the Postal Service? Instead of following the four-step procedure, let us think about the impact of each event separately. Then, we will put it on the same graph. First, let us tackle increasing compensation. This can be considered as an input cost as labor is a required component of mail delivery. Recall that an increase in input costs will lead to a decrease in the supply. Thus, the supply curve will shift inward. Next, let us tackle the change in the way people communicate. As people begin to use “snail-mail” less than ever, we can model the change as a decrease in the demand for mail service. Let us put both of those shifts on the graph and determine what happens to the equilibrium price and quantity.  Figure 3.16 Double Shift Figure 3.16 Double Shift

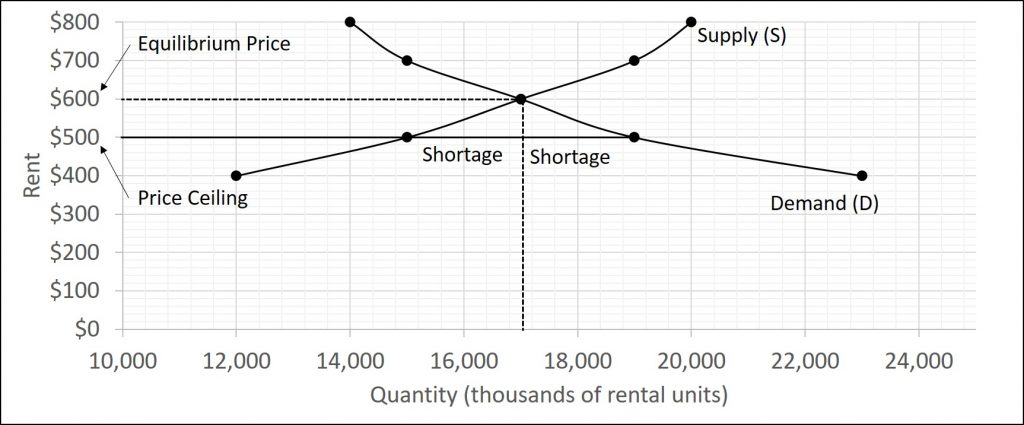

The inward shift of demand causes a decrease in both the equilibrium price and quantity. On the other hand, the decrease in supply causes an increase in the equilibrium price while it causes a decrease in the equilibrium quantity. Now, let us reconcile the two changes. The two changes caused both an increase and decrease in price. Therefore, there is no way for us to know the final impact on prices. The net effect is determined by which effect is larger (the demand shift versus the supply shift.) On the other hand, both shifts caused decreases in quantity. Therefore, we know there is a decrease in quantity. Thus, the net effect of the two shifts is an ambiguous change in price and a decrease in the equilibrium quantity. 3.5 Price controlsTo this point in the chapter, we have been assuming that markets are free, that is, they operate with no government intervention. In this section, we will explore the outcomes, both anticipated and otherwise, when government does intervene in a market either to prevent the price of some good or service from rising “too high” or to prevent the price of some good or service from falling “too low”. Economists believe there are a small number of fundamental principles that explain how economic agents respond in different situations. Two of these principles, which we have already introduced, are the laws of demand and supply. Governments can pass laws affecting market outcomes, but no law can negate these economic principles. Rather, the principles will become apparent in sometimes unexpected ways, which may undermine the intent of the government policy. This is one of the major conclusions of this section. Controversy sometimes surrounds the prices and quantities established by demand and supply, especially for products that are considered necessities. In some cases, discontent over prices turns into public pressure on politicians, who may then pass legislation to prevent a certain price from climbing “too high” or falling “too low.” The demand and supply model shows how people and firms will react to the incentives that these laws provide to control prices, in ways that will often lead to undesirable consequences. Alternative policy tools can often achieve the desired goals of price control laws while avoiding at least some of their costs and tradeoffs. Price CeilingsLaws that government enact to regulate prices are called price controls. Price controls come in two flavors. A price ceiling keeps a price from rising above a certain level (the “ceiling”), while a price floor keeps a price from falling below a given level (the “floor”). This section uses the demand and supply framework to analyze price ceilings. The next section discusses price floors. A price ceiling is a legal maximum price that one pays for some good or service. A government imposes price ceilings in order to keep the price of some necessary good or service affordable. For example, in 2005 during Hurricane Katrina, the price of bottled water increased above $5 per gallon. As a result, many people called for price controls on bottled water to prevent the price from rising so high. In this particular case, the government did not impose a price ceiling, but there are other examples of where price ceilings did occur. In many markets for goods and services, demanders outnumber suppliers. Consumers, who are also potential voters, sometimes unite behind a political proposal to hold down a certain price. In some cities, such as Albany, renters have pressed political leaders to pass rent control laws, a price ceiling that usually works by stating that landlords can raise rents by only a certain maximum percentage each year. Some of the best examples of rent control occur in urban areas such as New York, Washington D.C., or San Francisco. Suppose that a city government passes a rent control law to keep the price at the original equilibrium of $500 for a typical apartment. In Figure 3.16, the horizontal line at the price of $500 shows the legally fixed maximum price set by the rent control law. The quantity demanded at $500 is 19,000 units while the quantity supplied is 15,000. Therefore, there is a shortage of 4,000 units when rent control is enforced. One of the ironies of price ceilings is that while the price ceiling was intended to help renters, there are actually fewer apartments rented out under the price ceiling (15,000 rental units) than would be the case at the market rent of $600 (17,000 rental units).  Figure 3.17 Rent Control Figure 3.17 Rent Control

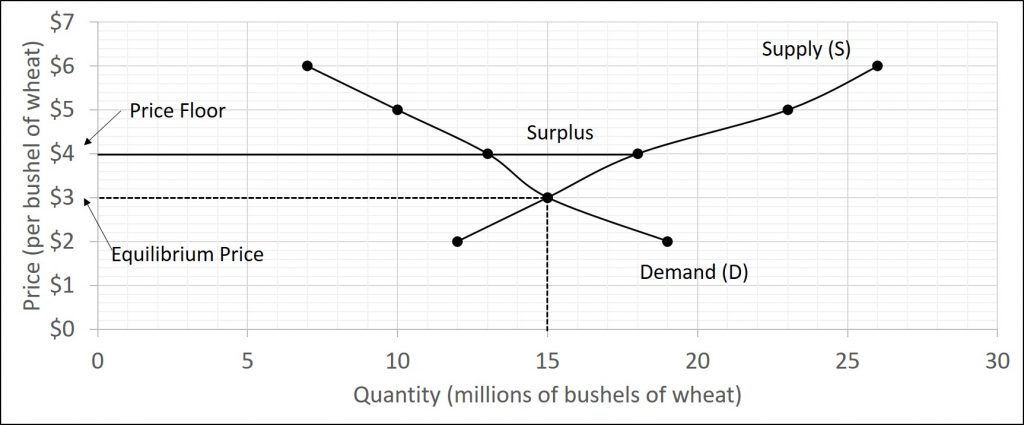

Price ceilings do not simply benefit renters at the expense of landlords. Rather, some renters (or potential renters) lose their housing as landlords convert apartments to co-ops and condos. Even when the housing remains in the rental market, landlords tend to spend less on maintenance and on essentials like heating, cooling, hot water, and lighting. The first rule of economics is you do not get something for nothing—everything has an opportunity cost. Thus, if renters obtain “cheaper” housing than the market requires, they tend to also end up with lower quality housing. Price ceilings are enacted in an attempt to keep prices low for those who need the product. However, when the market price is not allowed to rise to the equilibrium level, quantity demanded exceeds quantity supplied, and thus a shortage occurs. Those who manage to purchase the product at the lower price given by the price ceiling will benefit, but sellers of the product will suffer, along with those who are not able to purchase the product at all. Quality is also likely to deteriorate. Price ceilings can either be binding or non-binding. What has just be discussed is called a binding price ceiling since it prevents the market from achieving equilibrium. On the other hand, re-consider the last example. What if the price ceiling were set at $700? Some students believe that would cause the price to be set at $700 but this is incorrect. Remember, a price ceiling is just a legal maximum price. Therefore, a price ceiling of $700 only means that you cannot charge more than $700. So, even in the presence of the price ceiling, the market is able to achieve equilibrium. An important thing to keep in mind: if a market can achieve equilibrium, it will. The only time a price ceiling will have an impact on the market (that is, act as a binding price ceiling) is when the law makes the equilibrium price illegal. Price FloorA price floor is the lowest price that one can legally pay for some good or service. Perhaps the best-known example of a price floor is the minimum wage, which is based on the view that someone working full time should be able to afford a basic standard of living. The federal minimum wage in 2016 was $7.25 per hour, although some states and localities have a higher minimum wage. The federal minimum wage yields an annual income for a single person of$15,080, which is slightly higher than the federal poverty line of $11,880. As the cost of living rises over time, Congress periodically raises the federal minimum wage. Price floors are sometimes called “price supports,” because they support a price by preventing it from falling below a certain level. Around the world, many countries have passed laws to create agricultural price supports. Farm prices and thus farm incomes fluctuate, sometimes widely. Even if, on average, farm incomes are adequate, some years they can be quite low. The purpose of price supports is to prevent these swings. The most common way price supports work is that the government enters the market and buys up the product, adding to demand to keep prices higher than they otherwise would be. According to the Common Agricultural Policy reform passed in 2013, the European Union (EU) will spend about 60 billion euros per year, or 67 billion dollars per year (with the November 2016 exchange rate), or roughly 38% of the EU budget, on price supports for Europe’s farmers from 2014 to 2020. Figure 3.17 illustrates the effects of a government program that assures a price above the equilibrium by focusing on the market for wheat in Europe. In the absence of government intervention, the price would adjust so that the quantity supplied would equal the quantity demanded at the equilibrium price. For this example, let us say that the free-market equilibrium price is $3.00 per bushel. However, policies to keep prices high for farmers keeps the price above what would have been the market equilibrium level—the price floor is shown by the dashed horizontal line in the diagram. For this example, let us say that is $4.00 per bushel. The result is a quantity supplied in excess of the quantity demanded (Qd). When quantity supplied exceeds quantity demanded, a surplus exists.  Figure 3.18 Price floor Figure 3.18 Price floor

Economists estimate that the high-income areas of the world, including the United States, Europe, and Japan, spend roughly $1 billion per day in supporting their farmers. If the government is willing to purchase the excess supply (or to provide payments for others to purchase it)(also, there are times where the excess supply is simply destroyed), then farmers will benefit from the price floor, but taxpayers and consumers of food will pay the costs. Agricultural economists and policymakers have offered numerous proposals for reducing farm subsidies. In many countries, however, political support for subsidies for farmers remains strong. This is either because the population views this as supporting the traditional rural way of life or because of industry’s lobbying power of the agro-business.

|

【本文地址】